Phone:

(727)358-0489

Physical address:

13604 101st Terrace

Seminole, FL 33776

Florida property insurance premiums are on the rise in 2024. Get the latest insights from the Property Insurance Stability Report, learn how legislative reforms may impact your rates, and discover strategies to save with the My Safe Florida Home Program.

The 2024 Property Insurance Stability Report offers a comprehensive analysis of Florida’s property insurance market, revealing slight improvements in overall market stability. Despite these positive signs, the report emphasizes the continued struggle homeowners encounter with escalating insurance premiums. As Florida prepares for another hurricane season, the concerns surrounding the stability and affordability of property insurance intensify. The region’s vulnerability to severe weather exacerbates these challenges, making the need for reliable and affordable insurance coverage more critical than ever. This report aims to shed light on these issues and provide stakeholders with the necessary information to navigate the complexities of the insurance landscape in Florida.

Recent legislative reforms have introduced a wave of optimism in Florida’s property insurance market, which has long been fraught with volatility and high costs. These reforms are strategically designed to invite new insurers into the market, a move that promises to boost competition and encourage price stabilization. This legislative effort is particularly crucial in a state where the frequency of hurricanes has historically driven up insurance costs dramatically. By facilitating the entry of new players and enforcing regulations aimed at fair pricing and sustainability, the reforms seek to curb the steep premium increases that have burdened homeowners. These changes are essential for not only improving market conditions but also for ensuring that insurance remains accessible and affordable for all residents in hurricane-prone areas.

The 2024 Property Insurance Stability Report paints a detailed picture of the ongoing trends in Florida’s insurance market, particularly the continuous rise in premiums that many homeowners are grappling with. This upward trend in costs is significantly influenced by Florida’s high susceptibility to hurricanes, leading to more frequent and severe claims that, in turn, drive up premiums. Despite the daunting outlook of increasing rates at renewal, the report offers a hopeful forecast. It highlights the entry of new insurers into the market as a pivotal development that could bring about more competitive pricing. This influx is expected to counterbalance the prevailing high costs, providing some relief to homeowners. By expanding the insurance pool with new companies, the market dynamics are anticipated to shift, potentially stabilizing and even reducing premium costs over time.

Homeowners burdened by the escalating costs of insurance premiums in Florida have a valuable resource in the My Safe Florida Home program. This initiative encourages homeowners to undertake home inspections and apply for grants that fund essential upgrades to enhance structural resilience against severe weather. By fortifying their properties with stronger roofing materials, hurricane-proof windows, and reinforced doors, homeowners not only boost the safety and durability of their homes but also significantly diminish the risk factors insurers consider when determining premiums. These improvements can lead to considerable reductions in insurance costs, offering financial relief in an environment where premium hikes have become increasingly common. Engaging with this program not only secures a home against natural disasters but also ensures more manageable and lower insurance rates, providing long-term economic benefits. Click here to learn more about My Safe Florida Home program and how to apply.

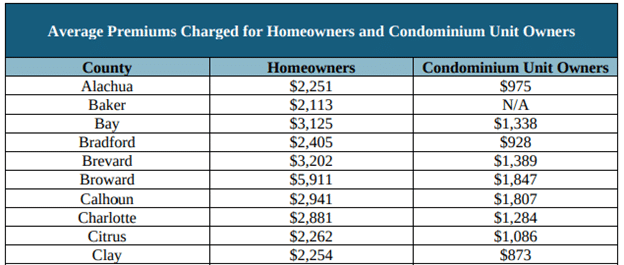

Insurance premiums in Florida exhibit significant regional disparities, reflecting the diverse risk profiles across the state. The 2024 Property Insurance Stability Report offers a detailed county-by-county breakdown, revealing that areas like Brevard and Orange County face some of the highest insurance costs in Central Florida, largely due to their proximity to the coast and higher risk of hurricane damage. This geographical variance is crucial for homeowners who need to evaluate the cost-effectiveness of their insurance options. By understanding the specific rates and risks associated with their locality, homeowners can make informed decisions about investing in structural improvements or seeking alternative insurers that offer more competitive rates, ultimately aiming to reduce their financial burden while maintaining adequate coverage.

The image displays a table listing average insurance premiums for homeowners and condominium unit owners across selected counties in Florida, with Broward County having the highest homeowner premiums at $5,911. Source: PROPERTY INSURANCE STABILITY REPORT, pg. 16.

The 2024 Property Insurance Stability Report illustrates Florida’s insurance market’s fluctuating and often challenging landscape. While recent legislative efforts and the entry of new insurers hint at a future with more stable and reasonable insurance pricing, homeowners must actively engage to navigate these changes effectively. It is essential for homeowners to stay informed about ongoing market trends, legislative developments, and available resources like the My Safe Florida Home program. This program not only aids in fortifying homes against severe weather through structural improvements but also facilitates potential reductions in insurance premiums. By proactively utilizing such resources, staying updated on insurance market changes, and implementing recommended protective measures, Florida homeowners can better manage their insurance costs and enhance their property’s resilience against natural disasters.